Welcome

You've got to plan for retirement?

Planning for retirement shouldn't be dreaded and avoided.

The most often asked question regarding retirement is "will the money last". Retirement Planner software helps to answer that and other questions. Whether you are early or late in the planning process it needs to be done. The statement "failing to plan is planning to fail" is just as applicable to retirement as it is to other aspects of life. This software can be used to create a forty-year retirement plan.

Many events and aspects of life will impact the quality of retirement. What the future holds for one in retirement is unknown. Yet, one can be prepared and educated about the challenges and opportunities of retirement. A knowledgeable and sound retirement plan will help now and in the future.

Though this software is titled Retirement Planner it can and has been used to assist with making financial decisions for decades before retirement.

What Retirement Planner does not provide

Retirement Planner does not provide any investment strategies or track historical performance of investments.

This software is not designed to replace the value of professional financial advice.

Plan for the future not the past

This software is designed to plan for the future and not track the past. The plan is always created with a current or going forward timeframe. When using this software and entering the target retirement year it must either be the current year or a future year. A target retirement start year prior to this year is not supported and cannot be entered. Even if you retired one or more years in the past the software uses the current year as the starting year for planning purposes.

Points of control

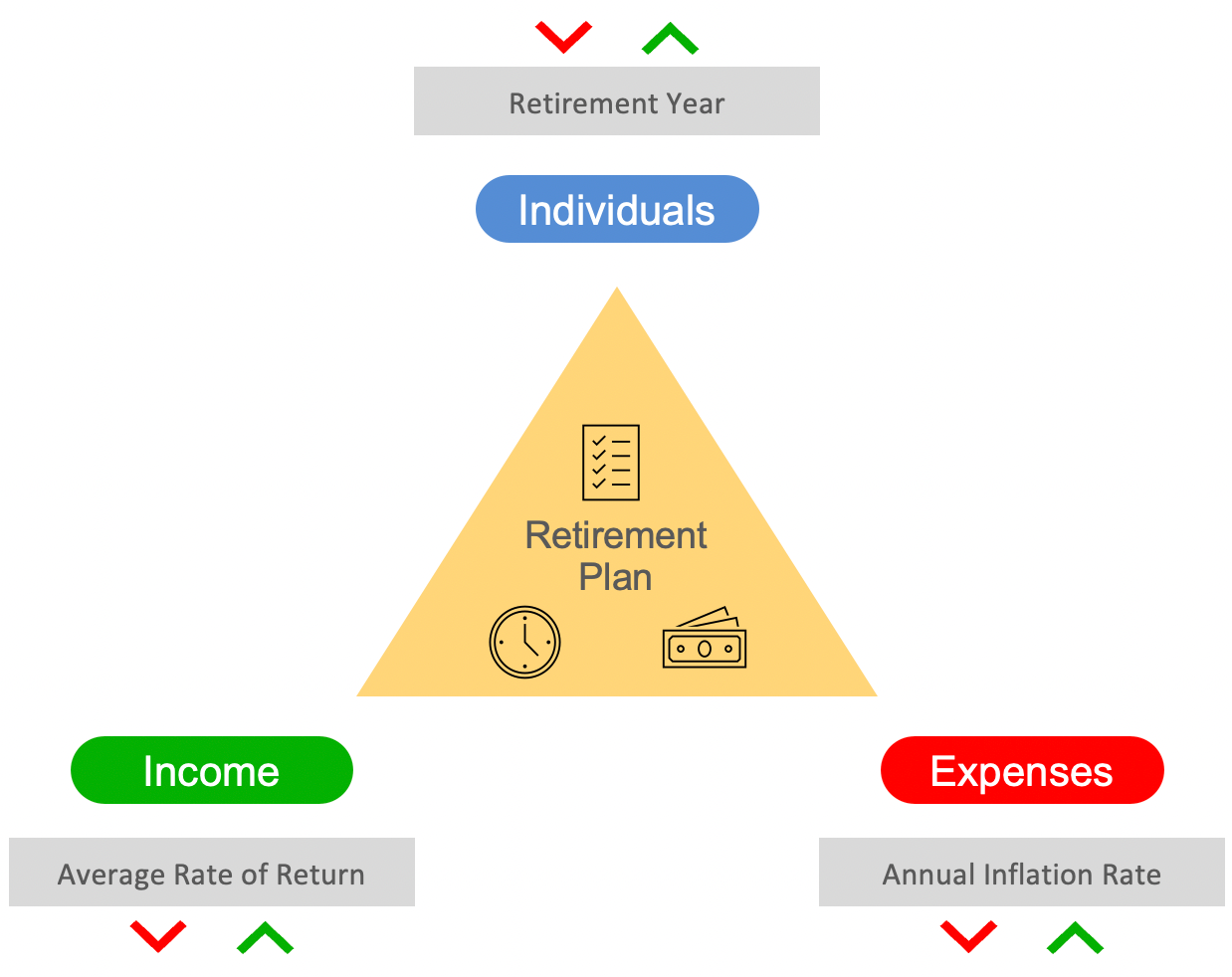

Retirement Planner provides three points of control and adjustment along with the financial data entered to create a plan. These points of control are 1) Retirement Year, 2) Average Rate of Return, and 3) Annual Inflation Rate. These controls are associated with Individuals, Income, and Expenses. Retirement Planner allows increasing or decreasing these points of control to understand the effects on the retirement plan. In real life some of these factors can be controlled. At other times these factors are out of our control.

How the plan is created

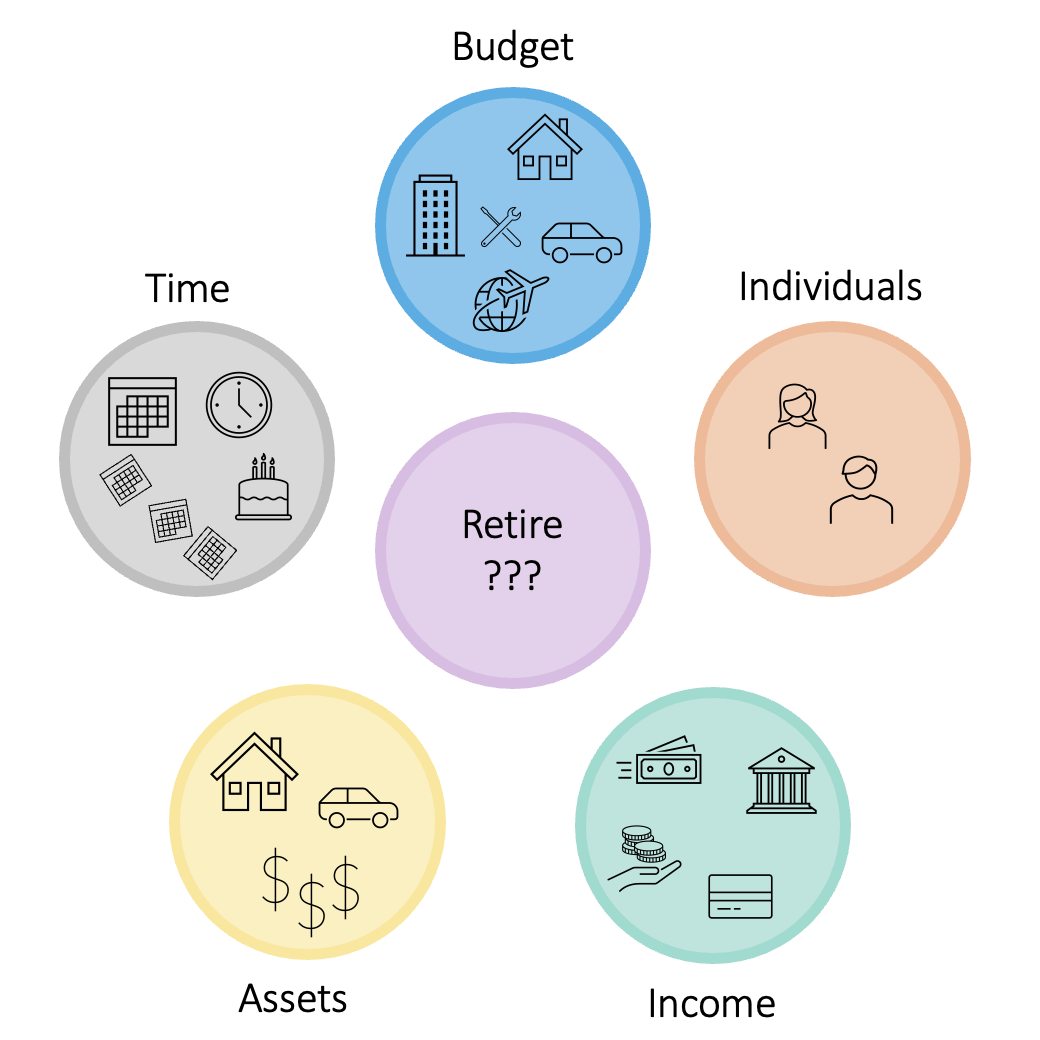

The overall objective of Retirement Planner is to aid in determining if the money will last. Data e.g., budget, income, assets, etc. must be entered and then analyzed over a period. The budget needs are weighed against the available income and investments.

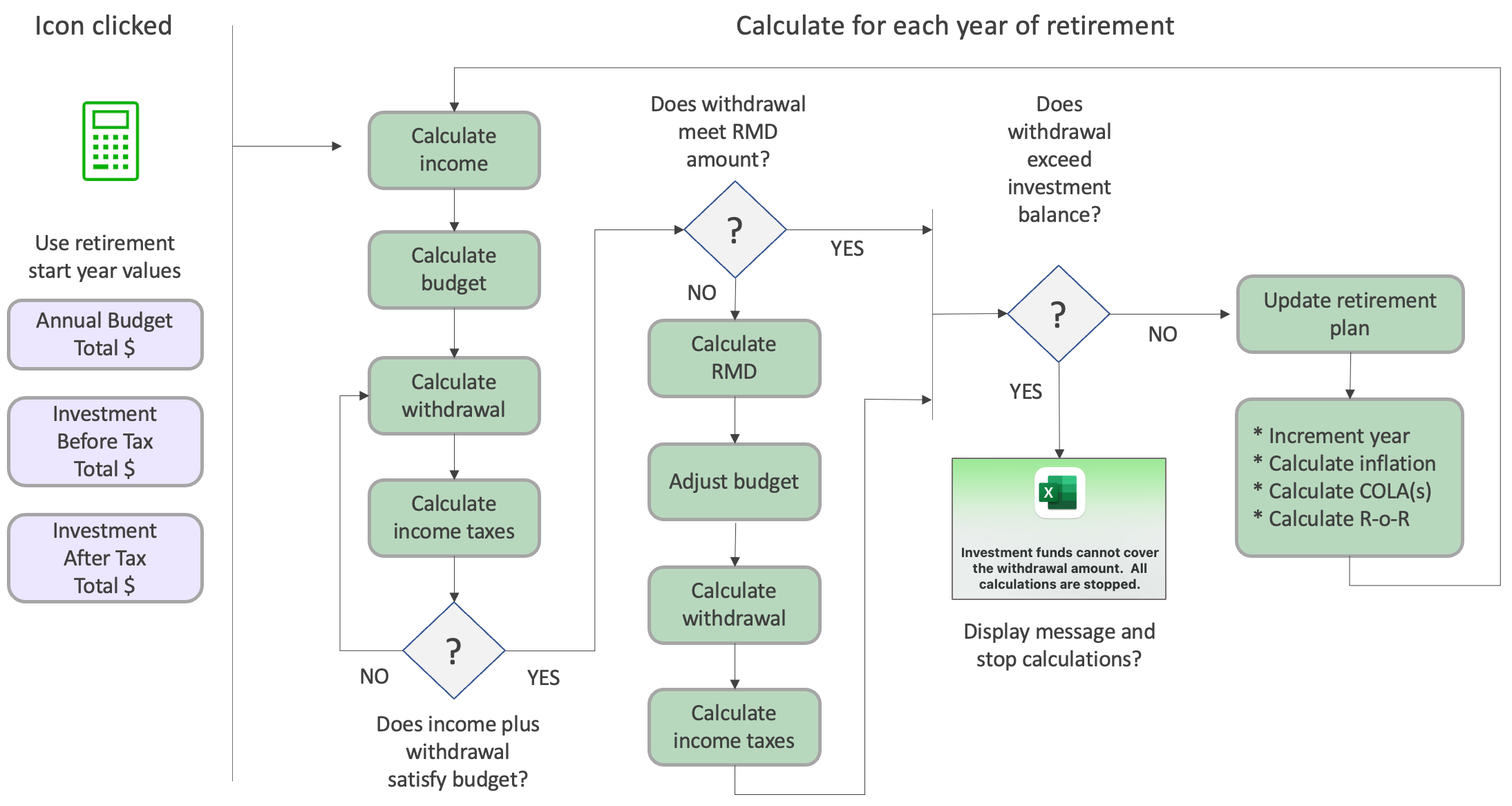

The following image shows the flow of how the retirement plan is generated. The generation starts calculations with the retirement year beginning values for budget, before tax investments, and after-tax investments. Each subsequent year of the forty-year plan will use a newly calculated and adjusted values. If the investment balance falls below the needed withdrawal for that year a message is displayed and calculations for following years are terminated.

The termination of calculations does not mean the plan has failed. This may be appropriate if the last year of successful calculations meets the retirement needs. If one is 85 years old and the plan can calculate for 20 years, then terminate for most this would be considered a successful retirement.

If the last successful plan year does not meet the needs, it is time to begin adjusting e.g., decrease budget needs, invest to get higher rate-of-return, possibly adjust inflation rate, can sale of house help, etc.

Features of Retirement Planner

Before tax and After tax monies

Most retirees will have some funds in a tax deferred account e.g., 401(k), 403(b), and will be required to pay tax on these funds when withdrawn. As there are tax implications and IRS Required Minimum Distribution (RMD) concerns Retirement Planner attempts to deal with these issues. When entering data for the INVESTMENTS section of the Assets tab the owner of the account and the classification (before/after tax) is required. More information about the impacts of these issues is described in the following sections.

Withdrawal amount calculation

Retirement Planner uses a "matching value" approach to calculate the withdrawal amount that is needed for each year. The matching occurs when available income is matched to the annual budget needs to calculate a withdrawal amount.

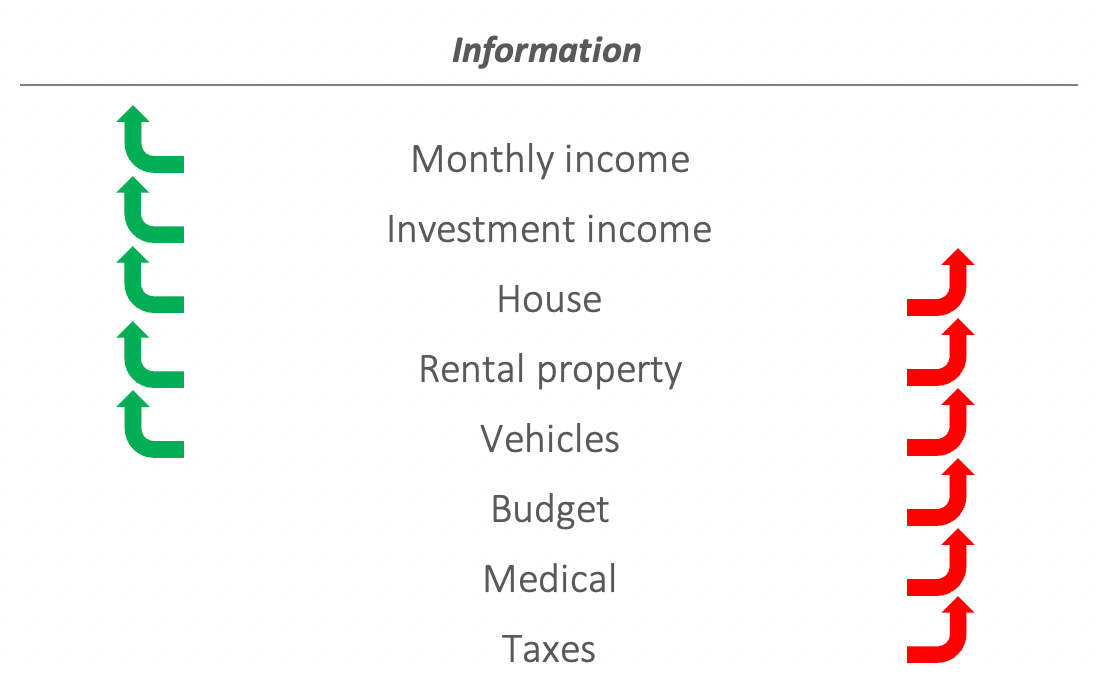

Notice in the following diagram that some information can impact Income and Expenses. For example, while owning an asset e.g., home, car, etc. there will be expenses incurred to maintain the asset, yet the same asset is considered income when sold.

Income tax calculation

Income tax rate tables are provided in this software for single and married filing status for Federal and all States plus D.C. Current provided tax rate tables are based on the 2021 year. County and City income tax rates may be entered on the 'TaxRates' tab if applicable.

The filing status and state to calculate taxes are selected by use the drop-down menus on the Individuals tab. Press the 'Update tax tables' button to create the formulas for calculating the income taxes. Taxes are calculated during the process when the green calculator icon is pressed.

From the Individuals and Income tabs the detail view for all income taxes can be accessed. The detail view TaxRates tab is where County and City tax rate tables are defined.

IRS Required Minimum Distribution (RMD) calculation

If there are any Before tax monies available and the calculated annual withdrawal amount is less than the IRS Required Minimum Distribution (RMD) amount the annual budget and withdrawal amounts are increased to satisfy the RMD amount. This increase is handled internal to the calculation and not shown in the Budget tab. The additional funds withdrawn to meet the RMD amount are taxed at the effective tax rate for that year. The remainder of the withdrawal funds, after taxes are taken out, are transferred to 'After tax' investments for future use.

Based on the date of birth for individuals 1 and 2 the RMD required start age is 70 if born before July 1, 1942 or start age of 72 if born after that date.

Monthly Income sources

Using the Income tab multiple sources of monthly income can be defined with start and end years, COLA (Cost of Living Adjustments), and percent taxable. Use of the start and end years provides the flexibility to define when the income is expected to stop or start. Thus, supporting when one ends work and begins drawing a pension, Social Security, Railroad Retirement, etc.

The percent taxable is essential to aid in calculating the proper income taxes. Defining an annual COLA percent for each source provides a means to increase future incomes.

Two additional income sources, Rental and Supplemental can be defined. Rental is the calculated monthly income from rental property if defined. Rental income is defined using on the Rental tab which is accessed from the Assets and Income tabs. Supplemental income is defined as an annual amount on the Income tab. Examples for supplemental income are: inheritance, profits from sale of vehicle, etc.

Home sale calculation

If a house is owned and will be sold, as defined in the Selling Home section of the Housing tab, there is an adjustment made to the budget by removing all existing house expenses from the sale year forward. All line items in the 'HOUSING' section of the Budget tab are what is removed from the budget. This removal of expenses should be offset with new housing costs that will be included in the budget. These new costs are entered in the 'Living expense after sale of home' section of the Housing tab.